Author : Haya Assem

Reviewed By : Enerpize Team

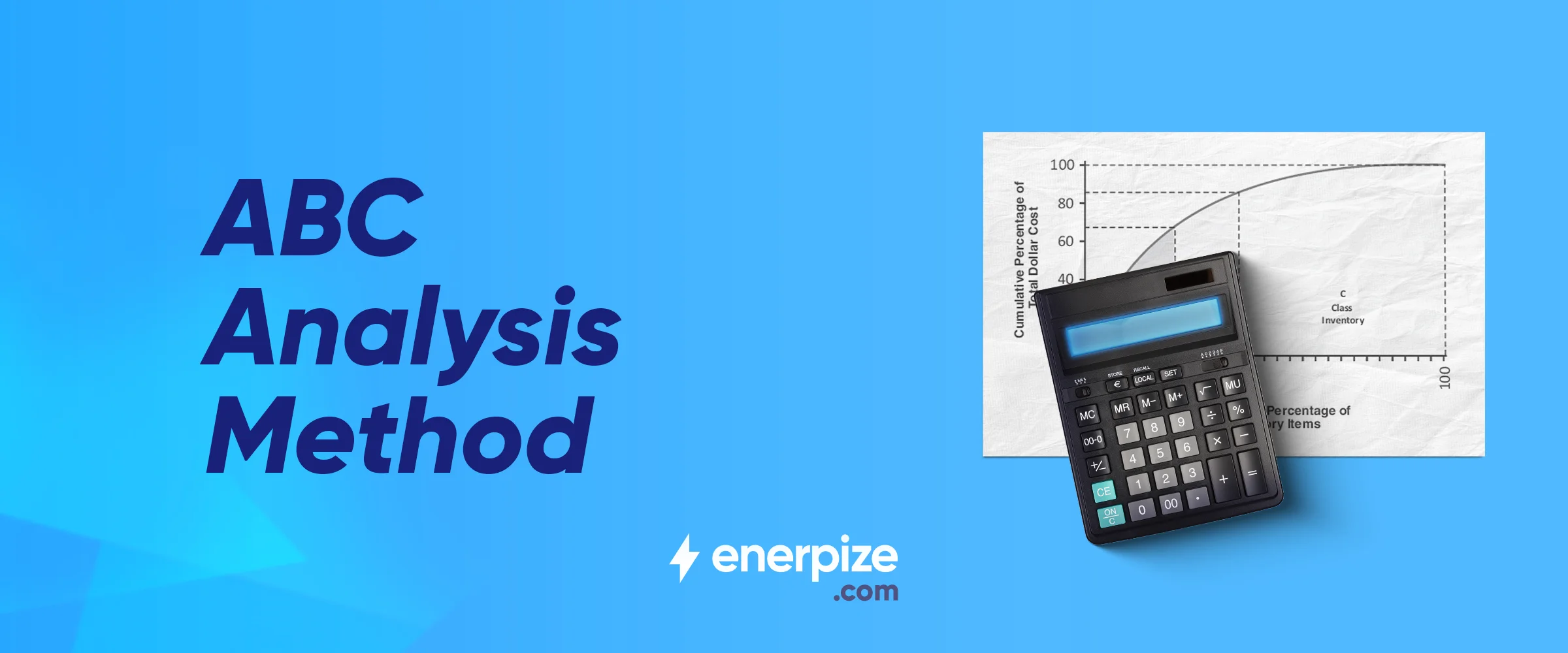

ABC Analysis Method: Definition, Advantages, and Disadvantages

Table of contents:

- Key Takeaways

- What is ABC Analysis?

- ABC Analysis Formula

- Example of Calculating ABC Analysis

- ABC Analysis Template

- Advantages of ABC Analysis

- Disadvantages of ABC Analysis

- 7 Essential Implementation Steps for ABC Analysis

- ABC Analysis Best Practices

- Limitations of the ABC Analysis Model

- How Enerpize Enhances Your Inventory Management

Effective inventory control and management are essential for the operational success of businesses in various industries. The key is to find the right balance between maintaining an adequate stock to meet demand and ensuring that the stock is aligned with customer needs. This helps prevent financial inefficiencies and lies at the core of efficient operations.

That is why businesses require a systematic framework for organizations to prioritize their resources and efforts, allowing them to focus on the most crucial aspects of their inventory management, which is where the ABC analysis comes in.

ABC analysis is a strategic inventory management method that classifies items into three categories based on their significance in terms of value and contribution to overall operational efficiency.

Key Takeaways

- ABC analysis categorizes items by importance to a business's cost structure. It aids accurate expense allocation by prioritizing high-consumption inventory. Categories include A-Items (high-value), B-Items (moderate-value), and C-Items (low-value).

- ABC analysis benefits companies by optimizing resource allocation, focusing on high-priority inventory (A-items), improving cost control, aiding strategic decision-making, identifying inefficiencies for improvement, and enabling more realistic budgeting based on accurate cost information.

- Despite its advantages, it has notable disadvantages. These include substantial resource requirements, posing challenges for businesses with limited resources, potential cost incompatibility with standard systems, the risk of loss due to excess stock exposure, a short-term focus, and complexities in shared resource allocation.

- It has notable disadvantages, including substantial resource requirements, posing challenges for businesses with limited resources, potential cost incompatibility with standard systems, the risk of loss due to excess stock exposure, a short-term focus, and complexities in shared resource allocation.

- Implementing ABC involves key practices for accurate cost insights and optimal resource allocation. Best practices include simplifying classifications based on movement or value, selecting strategic cost drivers, prioritizing value-adding activities, continuous model improvement, and evaluating surplus stock.

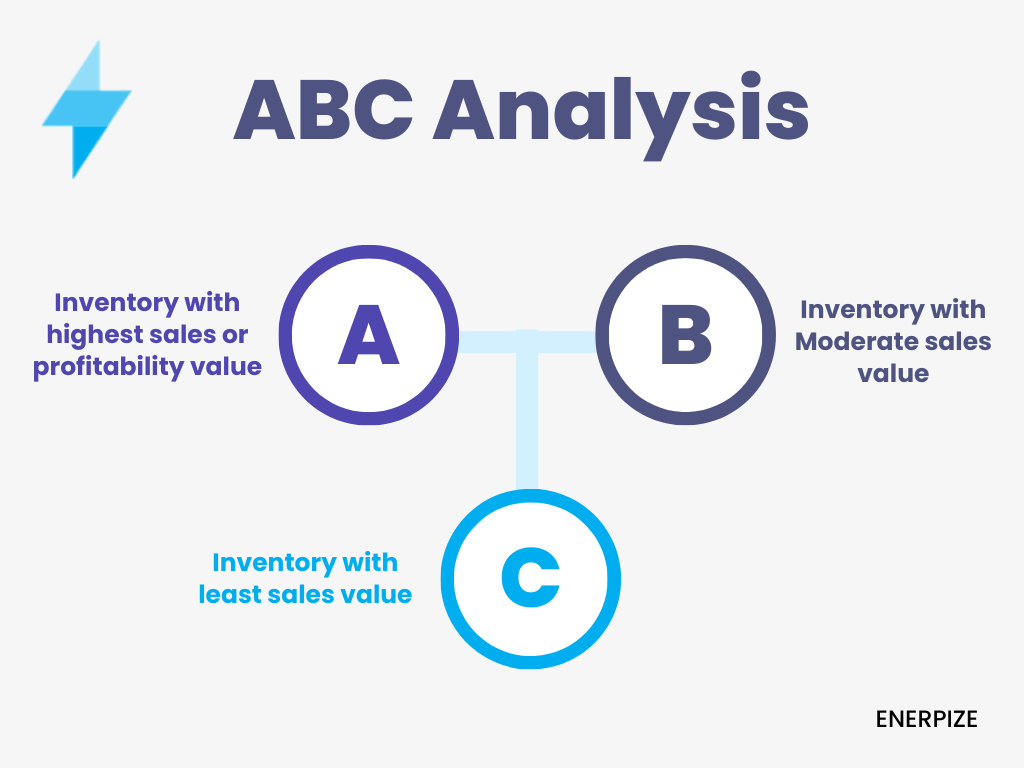

What is ABC Analysis?

The term "ABC" refers to Activity-Based Costing, a method that categorizes and classifies items or activities based on their relative importance to a business's overall cost structure. This analysis assists businesses in more accurately allocating expenses by prioritizing inventory with the highest annual consumption value.

The analysis involves classifying items or products into three categories:

- A-Items: These are high-priority products or items with the highest sales value or profitability and contribute substantially to the total cost.

- B-Items: These are moderate-priority products with a moderate sales value and have a moderate impact on the total cost.

- C-Items: These are low-priority items with the lowest sales value and have a minor impact on the total cost.

Read Also: Benefits of Using Inventory Management Software for Medical Clinics

ABC Analysis Formula

The formula typically relies on ranking items by their annual consumption value or other relevant criteria. The steps to perform ABC analysis are:

Calculate Annual Consumption Value (ACV):

ACV = Annual Demand × Cost per Unit

.png)

Example of Calculating ABC Analysis

Let's consider an example of ABC analysis in a retail setting with various products:

Items:

- Product A: High-value, high-demand item (Annual Consumption Value: $50,000)

- Product B: Moderate-value, moderate-demand item (Annual Consumption Value: $30,000)

- Product C: Low-value, low-demand item (Annual Consumption Value: $10,000)

Calculation:

Total Annual Consumption Value = $50,000 + $30,000 + $10,000 = $90,000

Percentage of Total ACV:

- Product A: ($50,000 / $90,000) × 100 = 55.56%

- Product B: ($30,000 / $90,000) × 100 = 33.33%

- Product C: ($10,000 / $90,000) × 100 = 11.11%

Ranking:

Rank the products based on their percentage of total ACV:

- Product A (55.56%)

- Product B (33.33%)

- Product C (11.11%)

Assign ABC Classes:

- Class A (Top 20%): Product A

- Class B (Next 30%): Product B

- Class C (Remaining 50%): Product C

ABC Analysis Template

Download our free ABC Analysis template and take control of your inventory with ease.

Read Also: Vendor-Managed Inventory: Definition, Types, and Advantages

Advantages of ABC Analysis

ABC analysis has various advantages that enable companies to make more informed choices and optimize resource allocation and others such as:

- The ABC analysis provides better control of high-priority inventory, allowing businesses to focus on the (A-items) with the highest customer demand or products that are often required and have the highest sales value.

- It can further improve cost control by providing precise insights that allow organizations to better track and manage costs by focusing on the items that have the greatest impact on total costs.

- ABC analysis enhances strategic decision-making by improving the understanding of cost drivers. This includes decisions related to the assortment of products, process improvements, and overall business strategy.

- Furthermore, ABC analysis identifies inefficiencies and highlights non-value-added items, allowing companies to focus on these areas for improvement. This can lead to cost savings and process improvements.

- Accurate cost information from ABC analysis allows for more realistic budgeting and planning. Based on a thorough understanding of cost structures, organizations may define more accurate financial objectives and manage resources.

Disadvantages of ABC Analysis

Although ABC analysis has several advantages, it still has disadvantages that should be considered when implementing this method. These disadvantages include:

- Substantial resource requirements: Including significant effort and time, pose challenges, particularly for businesses operating with limited resources or tight schedules. The combination of inaccuracies or outdated information, along with the resource-intensive nature of the process, can result in flawed outcomes, compromising the reliability of the analysis.

- Costing incompatibility: ABC inventory analysis is incompatible with typical costing systems and does not comply with generally accepted accounting principles (GAAP) standards. If you have to operate multiple costing systems, labor costs may rise due to increased inefficiency.

- Loss risk: The continual exposure of excess stock to damage or loss is a weakness in ABC analysis. The lower value of B and C items does not always make them useless in comparison to Class A products. As a result, products that are regularly overlooked or not checked risk being lost.

- Short-term strategy: ABC analysis may emphasize short-term, measurable activities, potentially neglecting long-term strategic considerations and investments that are essential for future growth.

- Shared resource allocation: Allocating costs to activities that share resources across multiple products or services can be challenging. This is because determining fair and accurate allocations may lead to complexities in the process of resource distribution.

7 Essential Implementation Steps for ABC Analysis

To achieve the successful integration of Activity-Based Costing (ABC) analysis into an organization's cost management system, several essential steps must be considered. Here are the key steps for ABC analysis implementation:

1- Identify Activities

Identify all organizational activities that contribute to the production of products or services. This involves understanding the processes and tasks involved in delivering value to consumers.

2- Activity Analysis

The objective is to meticulously analyze, understand, allocate, and track expenses linked to organizational operations. This comprehensive study aims to uncover the underlying costs of products or services, offering insights into all aspects of the products.

3- Assign Costs to Activities

Assign direct and indirect costs to each identified activity. This step involves understanding the resource consumption associated with each activity.

4- Determine Activity Rates

Calculate Activity Rates by assigning financial values to factors such as direct and indirect labor. Ensure that all relevant weightings, such as benefit costs, are taken into account. For example, you may express production work hours as a weighted labor rate.

5- Allocate Costs to Products/Services

Apply the calculated activity rates to products or services based on their consumption of the respective cost drivers. This step assigns costs more accurately to products.

6- Communication and Training

Instruct the right people on the new ABC methodology. Communicate the changes and benefits of ABC analysis to employees at all levels to ensure understanding and cooperation.

7- Continuous Improvement and Refinement

Continuously refine the ABC model based on feedback, changes in the business environment, and evolving cost structures. Periodic reviews and adjustments help maintain accuracy.

Read Also: What Is Average Inventory and How to Calculate?

ABC Analysis Best Practices

Implementing ABC (Activity-Based Costing) analysis entails several recommended practices to achieve accurate cost structure insights and optimal resource allocation. The following are essential ABC analysis best practices:

Simplify Classifications

Items should be grouped depending on their frequency of movement within the organization. Stockouts are more likely with fast-moving products. Alternatively, classify things by value or gross profit margin, with the most expensive in Class A, the middle in Class B, and the lowest in Class C.

Strategic Cost Driver Selection

Identify appropriate cost drivers that accurately reflect resource consumption by each activity. Strategic selection ensures meaningful insights and effective cost allocation.

Value-Focused Prioritization

Prioritize activities that add value to products or services. This strategic focus guarantees efficient resource allocation and cost management.

Continuous Enhancement

Review and update the ABC model regularly. Periodic assessments allow adaptation to changing business conditions, maintaining the accuracy and relevance of the analysis.

Evaluate Surplus Stock

Assess the relevance of surplus stock levels, considering potential risks and holding costs. Properly classify surplus inventory.

Employee Engagement

For understanding and collaboration, train staff and describe the objective and advantages of ABC analysis.

Technology Implementation

Utilizing specialized ABC software is critical for organizations looking to improve their cost management strategies. The inventory management software automates procedures, reduces mistakes, and delivers real-time data, enabling agile adaptation to changing business environments.

Limitations of the ABC Analysis Model

While ABC (Activity-Based Costing) analysis is useful in many ways, it does have major limitations. The ABC analysis model has the following key limitations:

Complexity

ABC models' complexity may make it challenging for some businesses to understand and effectively implement. This complexity can lead to resistance among employees and management.

Resource-Intensive Implementation

ABC analysis may be time-consuming and costly to implement. It necessitates thorough data gathering, comprehensive activity identification, and staff training.

Seasonal Demand

One of the major limitations of ABC Analysis is that it does not consider seasonal demand. This means that things can be classified as "A" even if they are only in great demand at specific seasons of the year. This might result in ineffective inventory management and lost sales opportunities.

Some Costs Are Difficult to Classify

Certain costs may be challenging to assign to specific activities, leading to difficulties in accurate cost allocation.

Read Also: Perpetual Inventory System: Definition, Formula, Calculations

How Enerpize Enhances Your Inventory Management

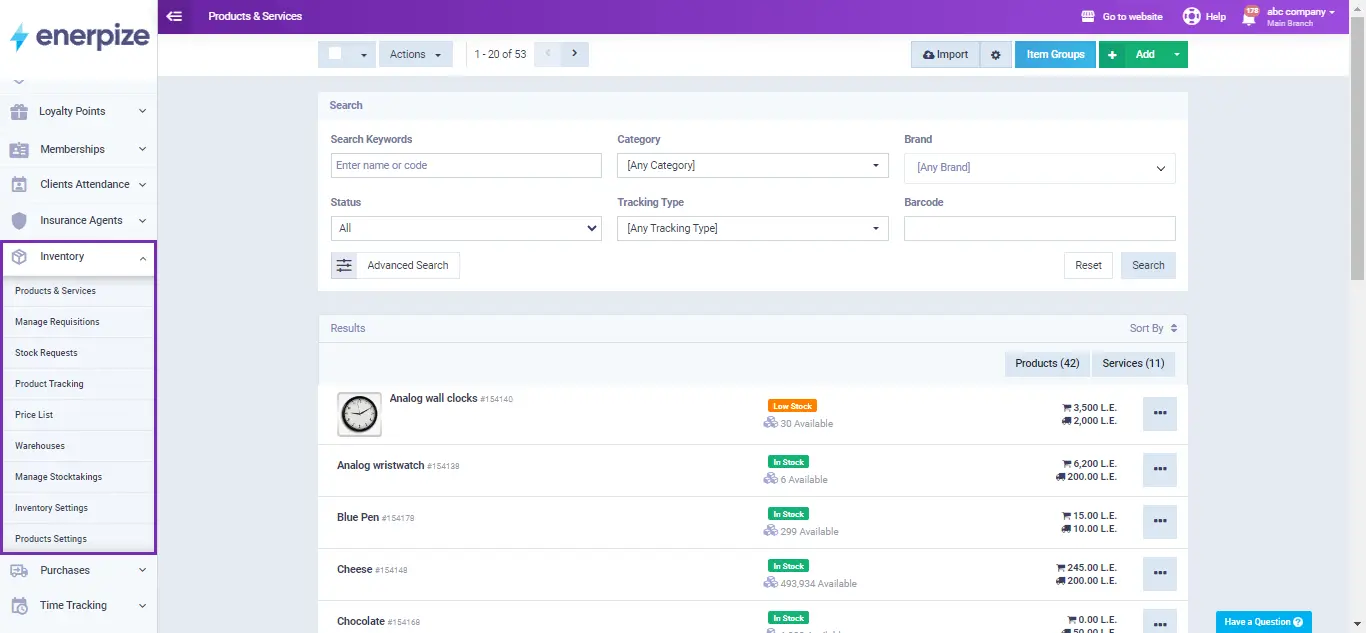

Enerpize inventory management software improves inventory management by allowing you to add products with unique SKUs, organize them by categories and brands, and set pricing details, including buy and sell rates, discounts, and suppliers. You can manage inventory settings by specifying initial stock levels and tracking methods.

Our system supports bundle and composite items, automatically adjusting inventory when bundles are consumed. Customize product units and track items using serial numbers, lot numbers, and expiry dates. Set stock limits to receive notifications for low inventory and manage multiple price lists efficiently. Enerpize also facilitates barcode integration for easy product identification and provides comprehensive reports on stock levels, stocktaking, and product bundles to keep your inventory well-organized and up-to-date.

Inventory management is easy with Enerpize.

Try our inventory module to control yours easily