Author : Haya Assem

Reviewed By : Enerpize Team

Liquid vs Illiquid Assets: Definition and Which Is Better?

Assets of all types are key components that influence the financial health of businesses, serving as essential resources for growth, stability, and operational success. In this context, one of the most common questions is: "What is the difference between liquid and illiquid assets?" Understanding this distinction is crucial, as it impacts cash flow management, risk assessment, and investment strategies.

Key Takeaways

- Liquid assets are easily converted into cash with little to no loss in value, supporting short-term needs and daily operations.

- Common liquid assets include cash, mutual funds, accounts receivable, CDs, marketable securities, and treasury bills.

- Pros of liquid assets: Quick access to cash, reduced financial risk, better debt and cash flow management, and enhanced business credibility.

- Cons of liquid assets: Lower returns, inflation vulnerability, interest rate sensitivity, and the risk of impulsive spending.

- Illiquid assets (like real estate, private equity, collectibles, and machinery) are harder to sell quickly and often require longer holding periods.

- Pros of illiquid assets: Higher potential returns, strong diversification, long-term stability, and insulation from daily market volatility.

- Cons of illiquid assets: Limited liquidity, longer lock-up periods, harder to sell, and delayed returns, making them less ideal for immediate financial needs.

What are Liquid Assets?

Liquid assets are assets that can be quickly converted into cash with minimal effort and without significant loss of value. They play an important part in a company's or individual's financial health by ensuring liquidity, which is the ability to meet short-term obligations without affecting ongoing business operations.

Examples of Liquid Assets

- Cash and Cash Equivalents: Cash on hand or in bank accounts and short-term investments that can be converted into cash immediately.

- Accounts Receivable: Money owed to a company by its customers for goods or services sold on credit, expected to be collected soon.

- Mutual Funds: Investment funds that pool money from multiple investors to purchase a diverse portfolio of stocks or bonds and can be sold quickly.

- Certificates of Deposit (CDs): Bank-issued savings instruments where funds are deposited for a specified term, often ranging from a few months to several years. In return, the bank pays a fixed interest rate.

- Marketable Securities: Financial assets, like stocks and bonds, that can be quickly sold on public exchanges.

- Inventory: Goods available for sale; while often considered less liquid than other assets, certain types of inventory can be sold quickly.

- Treasury Bills: Short-term government securities with maturities of one year or less, easily converted into cash.

- Government Bonds: Debt securities issued by governments with a fixed interest rate; some can be liquidated relatively easily.

Advantages of Liquid Assets

Liquid assets can be considered a business's financial safety net, always ready to support when opportunities or unexpected needs arise. These assets provide essential flexibility and security, ensuring businesses are well-prepared for both everyday expenses and sudden financial demands. The points below are the main advantages of Liquid Assets:

- Rapid Access to Cash: Liquid assets can be converted to cash almost immediately, providing funds for unexpected expenses or obligations without delay.

- Enhanced Portfolio Credibility: Liquid assets in a company’s portfolio signal financial stability and reliability, which can make the business more credible to investors or creditors.

- Flexible Financial Moves: Liquid assets allow businesses to make swift financial decisions, such as pursuing new investment opportunities or managing operating expenses, without needing to secure additional financing.

- Reduced Financial Risk: Maintaining liquid assets can help minimize overall financial risk by providing a safety net that can be utilized to manage downturns and avoid a cash crisis.

- Improved Debt Management: Liquid assets provide funds that can be quickly accessed to pay down debt, helping to keep debt levels manageable.

- Effective Cash Flow Management: By maintaining liquid assets, businesses can better manage cash flow needs, ensuring they have enough funds on hand to cover short-term expenses and obligations.

Disadvantages of Liquid Assets

While liquid assets offer valuable benefits, they also come with certain drawbacks that can impact financial growth and stability. It's important to be aware of these drawbacks to make informed investment decisions and balance between liquidity and growth potential. The listed points below are the key disadvantages of liquid assets.

- Lower Returns: Liquid assets usually yield lower returns compared to investments focused on growth (Illiquid Assets), as they prioritize accessibility over earning potential.

- Short-Term Investment Focus: Liquid assets often involve short-term investments, limiting opportunities for substantial long-term growth and value.

- Inflation Risk: Cash and cash equivalents may lose value over time due to inflation, as their returns often don’t keep up with rising prices, reducing their real value.

- Interest Rate Variability: Returns on many liquid assets are tied to interest rates, meaning they may be affected by rate fluctuations that can reduce earnings.

- Temptation to Spend: Easy access to cash may lead to impulsive spending or less disciplined financial behavior, affecting long-term financial objectives.

Read Also: What are Liquid Assets: Definition, Examples, and Formula

What are Illiquid Assets?

Illiquid assets are investments or properties that cannot be rapidly and easily converted into cash without incurring a considerable loss of value. Unlike liquid assets, which can be quickly sold, illiquid assets are long-term investments that often take longer to find a buyer and may involve substantial transaction costs or reductions in price during the sale process.

Examples of Illiquid Assets

- Private Equity: Investments in private companies that are not publicly traded, often require long-term commitments and limited options for selling.

- Hedge Funds: Investment funds that pool capital from accredited investors to engage in diverse strategies, typically with lock-up periods that limit immediate withdrawals.

- Collectibles: Tangible items like art, antiques, or rare coins that may increase in value but can take time to sell and find interested buyers.

- Real Estate: Properties such as land or buildings that often require significant time and effort to sell, depending on market conditions.

- Alternative Investments: Non-traditional investments such as commodities, or venture capital that may not be easily converted into cash and often involve longer holding periods.

- Equipment and Machinery: Physical assets used in business operations, such as manufacturing machines, vehicles, or specialized tools. These items can be difficult to sell quickly because they often require specific buyers and may not have a ready market.

Advantages of Illiquid Assets

While liquid assets often steal the spotlight for their quick access to cash, illiquid assets have their own special benefits. Illiquid assets are reliable, long-term assets that support your investment portfolio. They may not be as spectacular, but they bring unique benefits that can enhance your overall financial strategy. Here are the primary advantages of illiquid assets:

- Effective for Diversification: Illiquid assets can help diversify an investment portfolio by adding new risk and return characteristics that can improve overall performance.

- Potential for High Returns: Illiquid assets usually have the potential for significant returns, particularly in sectors such as private equity or real estate, where value can grow significantly over time.

- Improves Stability: Investing in illiquid assets can help create a more stable investment strategy by providing consistent income or increase over time, rather than being subject to short-term market fluctuations.

- Suitable for Long-Term Investment: Illiquid assets are often better suited for investors with a long-term perspective, as they may take years to realize significant gains.

- Reduced Market Volatility: Illiquid assets are less vulnerable to daily price changes and market trends, which can help investors avoid the volatility associated with more liquid investments.

Disadvantages of Illiquid Assets

While illiquid assets offer valuable long-term benefits, they also come with certain limitations that investors should consider. These assets can be less flexible and require a patient, strategic approach. The following are the disadvantages of illiquid assets:

- Higher Liquidity Risks: Illiquid assets are more susceptible to liquidity risks, meaning that investors may have difficulty converting these assets into cash, especially during market downturns.

- Longer Lock-Up Periods: Many illiquid investments have lock-up periods during which investors cannot sell their holdings. This can limit access to funds and restrict investment flexibility.

- Longer Time to Realize Returns: Illiquid assets often take longer to generate returns, as the asset value increases or income may require years to materialize. This can delay the overall investment payoff.

- Difficulty in Selling: Selling illiquid assets can be challenging due to a limited market and potential buyers. This can result in longer selling times or lower sale prices.

Liquid VS Illiquid Assets: Main Differences

One of the most often asked questions is, "What is the difference between liquid assets and illiquid assets?" Each type serves a specific role in financial planning and has distinct features. Liquid assets are typically easier to obtain and convert to cash, making them suitable for meeting immediate obligations. On the other hand, illiquid assets are held over a longer period, providing greater potential for growth and stability but less flexibility. Here are the main differences between liquid and illiquid assets:

1. Cash Accessibility

Liquid assets are valuable for quick cash access, helping businesses handle emergencies and meet obligations. However, their low returns, especially cash on hand, make them more susceptible to inflation.

Illiquid assets, while difficult to convert to cash, provide higher long-term returns and stability. However, they might be difficult to sell quickly, raising risks in financial situations and limiting immediate cash access.

2. Stability

Liquid assets tend to retain value well in the short term but may fluctuate with market trends.

Illiquid assets, on the other hand, often maintain their value over the long term but may be sold at a loss if a quick sale is necessary.

3. Market Availability

Liquid assets benefit from a broad and active market, with numerous buyers and sellers facilitating quick transactions. Illiquid assets have a limited market with fewer buyers, often requiring specialized transactions that can take longer to execute.

4. Potential Returns

Liquid assets generally offer lower returns due to their easy accessibility and lower risk profile. While illiquid assets can provide higher returns over time, as they are held longer and have the potential for significant appreciation.

5. Diversified Investments

Liquid assets are useful for maintaining liquidity but may offer limited diversification within a portfolio. Illiquid assets provide strong diversification, as they often do not correlate with traditional stock or bond markets, reducing overall portfolio risk.

Which is Better for Small Businesses: Liquid or Illiquid Assets?

Liquid assets are more suitable for small businesses because they provide the flexibility and quick access to cash that they frequently require for everyday operations, emergencies, and opportunities. This liquidity can be crucial for managing cash flow, especially in the early stages or during uncertain economic times.

However, the choice may still depend on the specific needs, goals, and financial situations of the business. For a more informed choice here are the pros and cons of each type:

Liquid Assets

Pros:

- Quick Access to Cash: Easily convertible into cash for emergencies and operating expenses.

- Flexibility: Enables small businesses to respond quickly to market changes and seize opportunities.

- Lower Risk: Generally less volatile, providing a safer option for maintaining cash flow.

Cons:

- Limited Returns: Typically yield lower returns than illiquid investments, limiting long-term growth.

- Inflation Vulnerability: Cash and equivalents can lose value over time due to inflation.

Illiquid Assets

Pros:

- Higher Potential Returns: Assets like real estate can appreciate and offer greater returns over time.

- Value Retention: Provide long-term stability and maintain their value.

Cons:

- Limited Liquidity: It is harder to convert to cash quickly, potentially causing cash flow issues in emergencies.

- Longer Investment Horizon: Requires a longer commitment, which may not align with immediate financial needs.

Read Also: How to Optimize Your Business Thanks to Accounting Software

How Can Enerpize Help You Managing Assets?

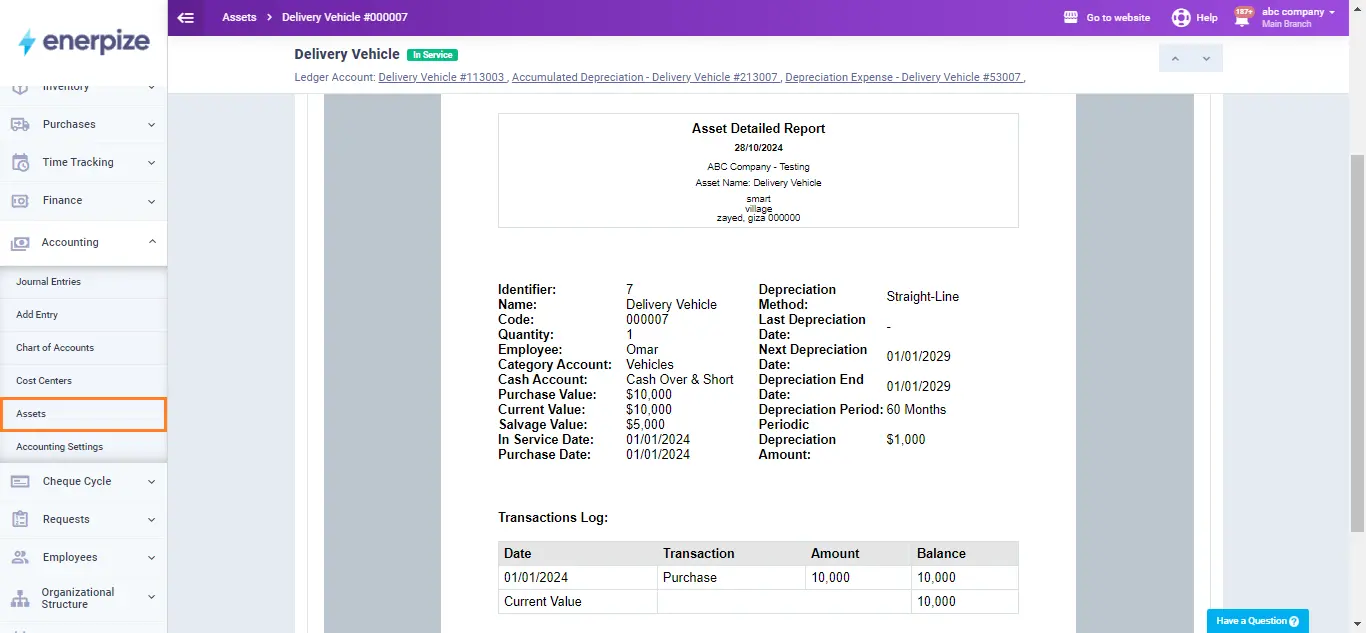

Enerpize simplifies fixed asset management by automating asset tracking and depreciation calculations. Users can manage various asset values (purchase, current, salvage) and assign employees to specific assets, ensuring organization through ready-made account categories. The software allows for adjusting depreciation rates and supports multiple methods compliant with GAAP, such as Straight-Line and Declining Balance.

ِAdditionally, you can automate depreciation processes or manually input depreciation entries as needed. Our fixed asset management software also enables you to manage asset value by writing off, selling, or re-evaluating assets based on their type, providing you with greater control over your asset management strategy.

Managing assets is easy with Enerpize.

Try our assets management module to manage your business's assets.