Author : Haya Assem

Reviewed By : Enerpize Team

Liquid Assets: Definition, Examples, and Formula

Table of contents:

- Key Takeaways

- What are Liquid Assets?

- Examples of Liquid Assets

- Importance of Liquid Assets for Small Businesses

- Liquid Assets Formula

- Example of Calculating Liquid Assets

- Why do You Need to Calculate Liquid Assets?

- Net Liquid Assets Formula

- Liquid Assets Ratio Formula

- How can Enerpize Help you Maintain Liquid Assets?

- FAQs About Liquid Assets

Understanding how to calculate liquid assets is critical for evaluating the financial health of any business or individual. Liquid assets are resources that can be quickly converted into cash, including cash, cash equivalents, and marketable securities, which are easily tradable in the market. This calculation helps assess a company’s ability to cover short-term obligations, handle unexpected expenses, and maintain financial flexibility. By adding cash, cash equivalents, and marketable securities, businesses can determine their liquidity and ability to meet immediate financial needs, ensuring stability and readiness for new opportunities. In this article, you'll find all you need to know about liquid assets.

Key Takeaways

- Liquid assets are resources that can be quickly converted into cash with little to no impact on their market value.

- Common examples of liquid assets include Cash and Cash Equivalents, Marketable Securities, Accounts Receivable, Inventory, and Short-Term Investments

- Liquid assets are crucial for small businesses to Cover Daily Expenses, Manage Unstable Cash Flow, Enhance Financial Credibility, and Reduce Reliance on Debt

- The basic formula for calculating liquid assets is: Liquid Assets = Cash + Cash Equivalents + Marketable Securities

- The Formula of Net Liquid Assets is: Net Liquid Assets = (Cash + Marketable Securities) − Current Liabilities

- Liquid Assets Ration Formula is: Liquid Assets Ratio = Liquid Assets ÷ Current Liabilities

- The importance of calculating liquid assets is to help businesses manage cash flow, avoid payment issues, and maintain stability. They also help investors and creditors assess a company’s financial health.

What are Liquid Assets?

Liquid assets are assets that can be easily converted into cash without a significant impact on their market value. They are valuable for businesses as they provide rapid access to required funds to cover short-term obligations or unexpected expenses. Liquid assets are essential for evaluating a business's liquidity, which is its ability to pay off current liabilities without selling long-term assets or investments.

Examples of Liquid Assets

Below are some examples of liquid assets that can help small businesses maintain operational efficiency:

Cash and cash equivalents

Cash is the most straightforward example of a liquid asset since it is available for immediate use. Cash equivalents, such as treasury bills, money market funds, and certificates of deposit (CDs), are also highly liquid investments that may be quickly converted into cash while retaining their market value.

Marketable securities

Stocks and bonds that are publicly traded on financial markets are also considered liquid assets because they may be quickly sold when cash is required, although their value may fluctuate with market conditions. Marketable securities are a great option for businesses to invest excess cash while still maintaining liquidity.

Accounts Receivable

Accounts receivable are money customers owe to the business for products or services received. While it is not as immediate as cash, it is usually collected within a short period. This makes accounts receivable a relatively liquid asset.

Read more: Accounts Receivable Turnover Comprehensive Guide

Inventory

Inventory can be considered a liquid asset in some industries, such as retail if it is in high demand and sells fast at or near its market value. However, inventory is typically less liquid than other assets since it might take longer to sell.

Short-term investments

These assets have a one-year maturity, such as short-term government bonds or commercial paper, and are therefore relatively liquid. Because these assets may be swiftly converted into cash without losing significant value, they provide businesses with an option to store cash in a way that’s both safe and accessible.

Importance of Liquid Assets for Small Businesses

Small businesses often face unexpected financial challenges and are usually unprepared to deal with them, making liquid assets essential. They serve as a quick backup for small businesses, allowing them to quickly convert these assets into cash, which can then be used to cover emergency expenses and obligations.

Liquid assets provide the flexibility that small businesses require in critical situations, preventing them from seeking external debts or interrupting operations. This ability to quickly access cash helps small businesses stay resilient, handle unexpected costs, and maintain stability even when unplanned expenses arise.

Covering Daily Operational Expenses

Liquid assets are essential to cover the business's day-to-day expenses such as rent, utilities, salaries, and supplier payments. Businesses can cover these expenses more easily with liquid assets, especially cash, rather than waiting on receivables or liquidating long-term investments (Illiquid Assets).

Managing Unstable Cashflow

Small businesses may have unstable cashflows, particularly if they rely mainly on client payments. Liquid assets serve as financial support, helping to meet expenses during periods of low cash flow while not interrupting business operations.

Enhancing Financial Credibility

Strong liquid assets boost a business's creditworthiness, making it more appealing to lenders and investors. Lenders prefer organizations with strong liquidity since it indicates stability and the ability to meet short-term obligations. For small businesses, higher creditworthiness means easier access to funding and potentially more favorable loan terms.

Reducing Reliance on Debt

Liquid assets offer readily accessible cash, enabling small businesses to reduce their reliance on loans or credit. This approach minimizes interest expenses and helps avoid the long-term financial commitments associated with debt, leading to greater financial flexibility and stability.

Liquid Assets Formula

Calculating liquid assets involves a straightforward formula that measures a company’s ability to meet its short-term obligations using its most accessible resources. The formula focuses on highly liquid assets, such as cash and marketable securities, which can be quickly converted into cash without significant loss of value.

This formula can be defined as follows:

Liquid Assets = Cash and Cash Equivalents + Marketable Securities

- Cash and Cash Equivalents refer to actual cash on hand or in a bank account, as well as highly liquid short-term investments that are easily accessible such as checking accounts, savings accounts, and certificates of deposit (CDs).

- Marketable Securities are short-term investments that can be quickly converted into cash, such as publicly traded stocks, bonds, and other financial instruments that can be easily sold.

Example of Calculating Liquid Assets

For example, a software development company needs to determine its ability to meet short-term obligations. The company has $30,000 in its bank account and possesses stocks and bonds worth $40,000.

The company has the following financial details:

- Cash: $30,000 (available amount in the bank)

- Marketable Securities: $40,000 (Stocks and Bonds that can be quickly sold for cash)

The formula for calculating liquid assets is:

Cash and Cash Equivalents + Marketable Securities

$40,000 + $30,000 = $70,000

The company has $70,000 in liquid assets available which means that the company can comfortably meet its immediate financial obligations.

Why do You Need to Calculate Liquid Assets?

Calculating liquid assets is crucial because it helps businesses determine their short-term financial health and meet immediate obligations. It indicates how much readily available cash or easily convertible assets a business possesses to meet its current liabilities.

Knowing a company's liquid asset position allows it to manage cash flow risks better and avoid problems with bill payment or debt servicing. Accurately calculated liquid assets boost financial stability and business credibility since having more liquid assets indicates good financial stability and minimizes the danger of insolvency or failure in the short term.

Furthermore, investors and creditors often use liquid assets to determine if a business can weather financial challenges or downturns, which helps in investment decisions or lending assessments.

Net Liquid Assets Formula

The formula for net liquid assets represents the amount of easily accessible liquid assets a company or individual has, after subtracting immediate financial obligations (current liabilities). It provides an overview of liquidity, showing how many cash resources are available to cover short-term debts.

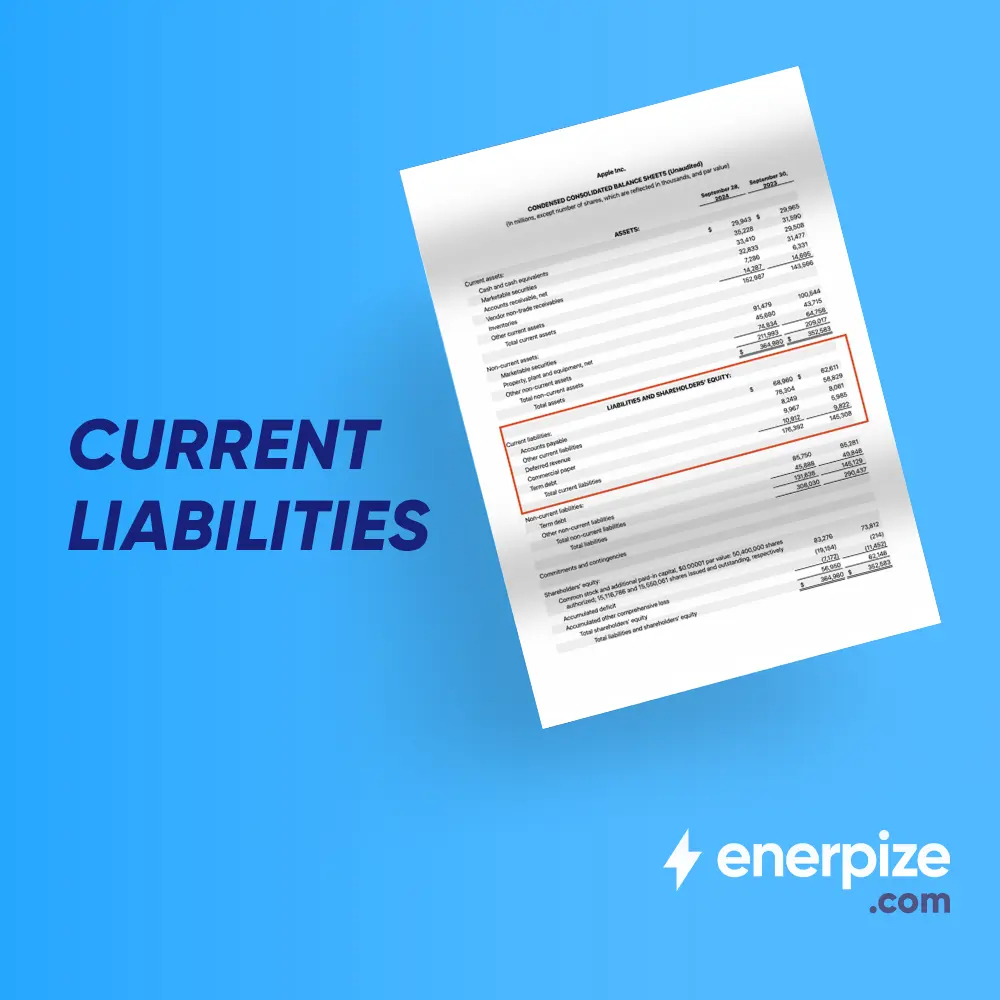

Net Liquid Assets = (Cash + Marketable Securities) - Current Liabilities

The formula essentially calculates how much liquidity is available after covering short-term obligations. It's an important metric for understanding an organization’s ability to manage day-to-day operations without facing liquidity issues.

Example of Net Liquid Assets Calculation

A digital marketing agency needs to determine its ability to meet short-term obligations. The company has $50,000 in its bank account and possesses stocks and bonds worth $30,000. It also owes one of its suppliers $40,000.

The company has the following financial details:

- Cash: $50,000 (available amount in the bank)

- Marketable Securities: $30,000 (Stocks and Bonds that can be quickly sold for cash)

- Current Liabilities: $40,000 (Accounts Payable)

The formula for calculating net liquid assets is:

(Marketable Securities + Cash) – Current Liabilities

($50,000 + $30,000) - $40,000 = $40,000

The company has $40,000 in liquid assets available after covering its $40,000 in short-term obligations. This means the company can comfortably meet its immediate financial obligations and still have a balance of liquid assets.

Liquid Assets Ratio Formula

The liquid assets ratio is a financial metric that assesses a company's ability to meet its short-term liabilities using its most liquid assets. A specific type of liquidity ratio, it focuses on the proportion of short-term debt that can be covered by cash, cash equivalents, and marketable securities. A higher ratio is generally seen as favorable, as it indicates the company is better positioned to fulfill its short-term obligations.

Liquid Assets Ratio = Liquid Assets ÷ Current Liabilities

Liquid assets refer to the total of cash, cash equivalents, and marketable securities (the same items used in the calculation for net liquid assets). Current Liabilities as mentioned before are the obligations that need to be settled within a short period.

Implications of Different Liquid Assets Ratios

- A ratio of 1.0 indicates that the company has exactly enough liquid assets to meet its current liabilities.

- A ratio greater than 1.0 indicates that the company has more than enough liquid assets to cover its short-term obligations.

- If the ratio is less than 1.0, it means that the company's liquid assets are insufficient to fulfill its current liabilities, which might indicate liquidity issues.

Example of Liquid Assets Ratio Formula

Let's consider a construction company that is assessing its liquidity position. The company has the following liquid assets:

- Cash: $40,000 in cash available in its bank account,

- Cash Equivalents: $30,000 in the form of short-term investments,

- Marketable Securities: $20,000.

In total, the company's liquid assets amount to $90,000. On the other side, the company has $90,000 in short-term liabilities, which it needs to settle within the next 12 months, such as outstanding invoices, payroll, and other operational expenses.

Liquid Assets Ratio = (40,000 + 30,000 + 20,000) ÷ 90,000

Liquid Assets Ratio = 1

How can Enerpize Help you Maintain Liquid Assets?

Enerpize is a comprehensive accounting software that simplifies the management of liquid assets, such as cash and marketable securities, providing real-time insights into a company’s financial health. It automatically tracks key financial resources, helping businesses maintain an accurate and up-to-date view of their liquidity and ability to meet short-term obligations.

Key features include real-time cash flow tracking, automated balance sheet generation, and streamlined accounts receivable management, all of which improve cash inflow and liquidity. Enerpize also offers automated bank reconciliation for faster error detection and effective expense tracking to help identify cost-saving opportunities.

By automating these processes, Enerpize's fixed asset management software saves time, reduces manual errors, and ensures accurate financial reporting, empowering businesses to make informed decisions and maintain financial stability.

Take control of your business liquidity today with Enerpize — start a free trial and experience the difference!

FAQs About Liquid Assets

How are Liquid Assets Different From Other Assets?

The distinction between liquid vs illiquid assets or other types lies in how quickly they can be converted into cash without a loss in value. Liquid assets can be accessed or sold with minimal effort, making them ideal for covering short-term obligations and unexpected expenses. In contrast, illiquid assets like property or equipment may require more time and effort to sell, often involving additional costs. This immediate accessibility of liquid assets is crucial for maintaining financial flexibility.

What is Considered a Liquid Asset?

Cash and cash equivalents, such as treasury bills and money market funds, are considered highly liquid assets. Marketable securities, like stocks and bonds, can also be quickly sold, although their value may fluctuate.

Accounts receivable, money owed by customers, is typically collected in a short period, making it relatively liquid. Short-term investments, such as government bonds, are also liquid due to their quick conversion to cash. Inventory can be liquid in industries like retail if it sells quickly at market value, but it is generally less liquid than other assets.

Is a Car a Liquid Asset?

A car is generally not considered a liquid asset because it cannot be quickly converted into cash without significant time and potential loss of value. Selling a car usually involves finding a buyer, which can take time, and the resale price might vary depending on factors such as model and market demand.

Additionally, transaction costs such as advertising and commissions can further reduce the cash received from the sale. Moreover, cars depreciate over time, meaning they may not retain their initial purchase price. Thus, while cars hold value, they do not meet the criteria for liquid assets. So, a car is not a liquid asset.

Are Stocks Liquid Assets?

Yes, stocks are considered liquid assets because they can be quickly converted into cash by selling them on the stock market. The market typically has a large number of buyers, allowing for fast transactions.

How to Find Liquid Assets from the Balance Sheet?

To find liquid assets from a business's balance sheet, focus on the items that represent cash or assets that can quickly be converted into cash. Here are a few examples:

Look for Cash and Cash Equivalents:

- Cash: This includes physical cash, checking accounts, and any other forms of readily available cash.

- Cash Equivalents: These are short-term, highly liquid investments, such as money market funds or short-term Treasury bills, that can be quickly converted into cash with minimal risk.

- Find Marketable Securities: These are investments that can be sold or liquidated quickly, such as stocks, bonds, or certificates of deposit (CDs). They are listed under "Current Assets" on the balance sheet.

- Check for any other liquid assets: Occasionally, some companies may hold other assets considered liquid (like accounts receivables that are expected to be collected in the short term).

Liquid assets calculation is easy with Enerpize.

Try our assets management module to manage your assets.