Author : Haya Assem

Reviewed By : Enerpize Team

The Accounts Receivable Turnover Guide

Table of contents:

- What is the Accounts Receivable Turnover Ratio?

- Accounts Receivable Turnover Ratio Formula

- How to Calculate Accounts Receivable Turnover Ratio

- When to Use the Accounts Receivable Turnover Ratio?

- 8 reasons why Accounts Receivable Turnover Ratio is Important for your Business

- What's a Good Receivables Turnover Ratio?

- Accounts Receivable Turnover Ratio Example

- Limitations of the Accounts Receivable Turnover Ratio

The shopping world is today dominated by Buy Now, Pay Later (BNPL) apps and similar deferred payment models, putting businesses at the crossroads of convenience and financial complexity.

Customers are often classified into two types: cash customers and customers who prefer deferred payments, which is the more popular kind, although this may make managing cash flow difficult for businesses. That's where the "Accounts Receivable Turnover Ratio" comes in. It's like a tool that shows how good a business is at handling delayed payments.

This ratio acts as an indicator, providing insight into how swiftly a company can turn credit sales into cash, which is critical for sustaining a healthy cash flow. Understanding the Accounts Receivable Turnover Ratio, whether you're a seasoned business or new to financial management, is the same as discovering the secrets of effective credit management.

Key Takeaways

- The AR Turnover Ratio is a crucial tool indicating a business's efficiency in converting credit sales into cash, impacting overall cash flow and revealing insights into credit management effectiveness.

- The ratio is calculated by dividing net credit sales by average accounts receivable, the ratio is regularly assessed to gauge performance, aiding in balance sheet projections, liquidity assessment, and effective budgeting.

- Monitoring the AR Turnover Ratio is essential for cash flow management, credit policy evaluation, early detection of collection issues, and building investor and creditor confidence.

- A higher ratio is generally positive, the ideal ratio varies based on industry norms. Awareness of industry specificity, potential lack of detailed insight, and seasonal considerations are crucial for accurate evaluation. Continuous monitoring and contextual analysis help businesses adapt to industry dynamics.

- The Accounts Receivable Turnover Ratio, while valuable for assessing receivables management, has limitations. Industry variations require context-specific comparisons, and the ratio may lack detailed insights into turnover changes. Seasonal sales fluctuations can impact accuracy, and discrepancies arise when businesses use total sales instead of net sales, requiring careful evaluation.

What is the Accounts Receivable Turnover Ratio?

The accounts receivable turnover ratio is a financial indicator that shows how many times a company collects payments from its customers over a given time period. It is calculated by dividing net credit sales by average accounts receivable.

A higher rate often suggests that the company is collecting payments faster, which is a positive indicator. A lower rate, on the other hand, may indicate that customers take longer to pay, affecting the cash flow and even highlighting problems with credit policy or customer payment sequences.

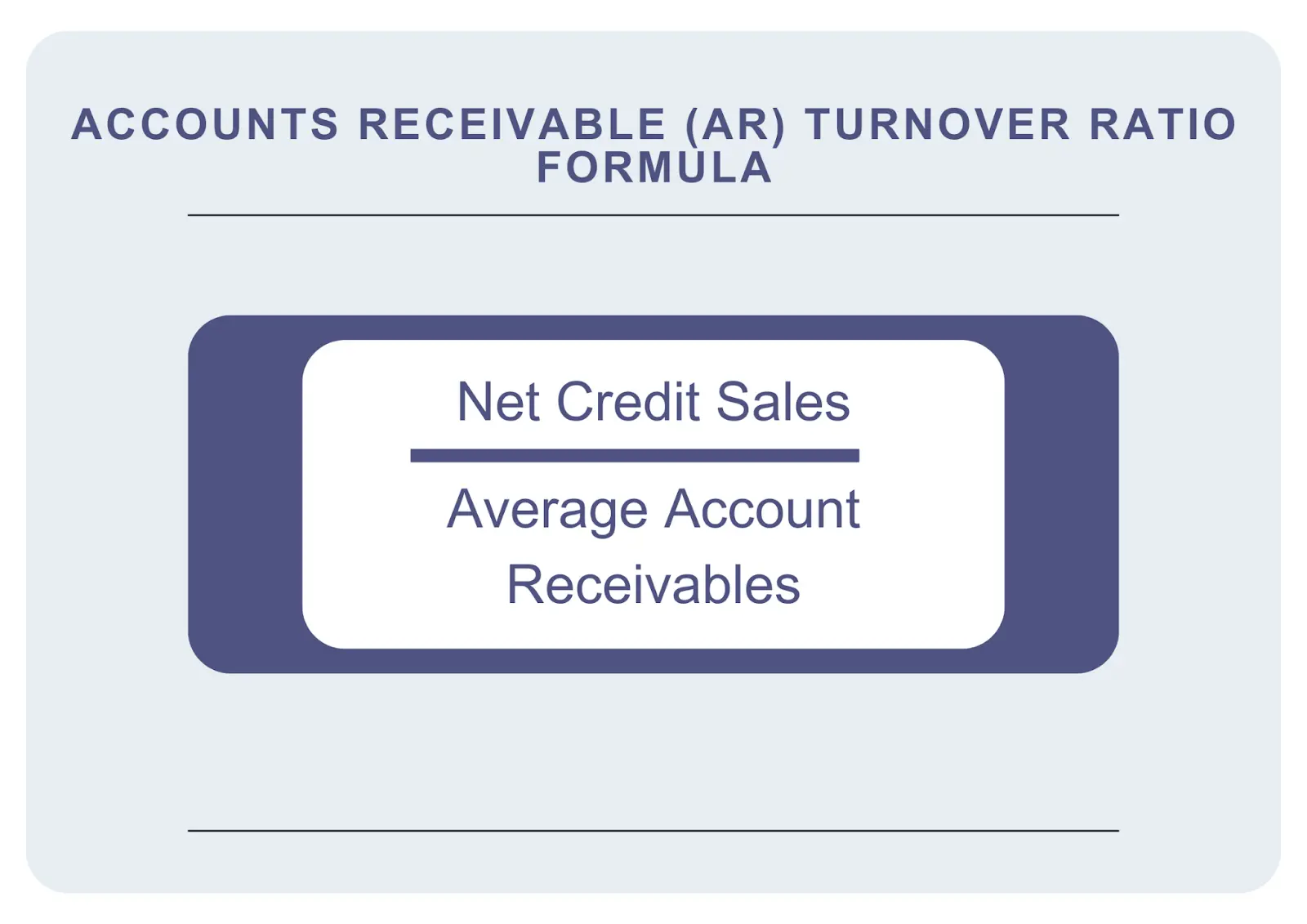

Accounts Receivable Turnover Ratio Formula

The AR Turnover Ratio is calculated by dividing net credit sales by average accounts receivable.

Net Credit Sales: This is the total amount of credit sales made within a certain time (excluding cash sales). It indicates revenue that has been recognized but has yet to be collected in cash.

Accounts Receivable Average: Accounts Receivable are payments owed to a company by customers for products or services acquired on credit.

How to Calculate Accounts Receivable Turnover Ratio

To calculate the Accounts Receivable Turnover Ratio, follow these 3 basic steps:

1st Step: Determine Net Credit Sales

Start by calculating the total credit sales made within a certain time period. This entails totaling all income earned by credit transactions while eliminating any cash sales. Net Credit Sales are basically sales for which payment is expected later.

Net Credit Sales = Total Sales − Cash Sales

2nd Step: Find the Average Accounts Receivable

Determine the beginning and ending sums of accounts receivable for the same period. Accounts receivable indicate the amounts that are due by customers for credit-purchased products or services.

To calculate the average, add the starting and ending accounts receivable balances, then divide the total by two to get the average accounts receivable for the period as illustrated in the Average Accounts Receivable formula:

Average Accounts Receivable = Beginning Accounts Receivable + Ending Accounts Receivable ÷ 2

3rd Step: Calculate the Accounts Receivable Turnover Ratio

After determining the Net credit sales and the average accounts receivable, now apply the AR turnover ratio to calculate the ratio:

AR Turnover Ratio = Net Credit Sales / Average Accounts Receivable

Note: Both values should represent the same accounting period.

When to Use the Accounts Receivable Turnover Ratio?

The receivable turnover formula should be used regularly at specific time intervals to assess a company's efficiency in managing its accounts receivable.

Companies calculate their turnover ratio on a monthly, quarterly, or annual basis to evaluate how quickly credit sales are converted into cash.

Furthermore, comparing the Accounts Receivable Turnover Ratio across different periods or against industry benchmarks. This allows businesses to gauge their performance relative to historical data or industry standards.

AR turnover ratio may be used by finance teams when preparing balance sheet projections since it provides a broad estimate of when receivables will be paid. This enables businesses to estimate how much cash they will have on hand in order to better manage their spending.

It could also be used to assess the impact of accounts receivable on liquidity. A lower ratio may suggest potential liquidity challenges. In comparison, a higher ratio indicates efficient management of receivables, which is a positive sign for investors and external stakeholders when evaluating a company's creditworthiness.

Download Now: Free Accounts Receivable Excel Template

8 reasons why Accounts Receivable Turnover Ratio is Important for your Business

The AR turnover ratio matters since it is an effective indication of many financial factors that can adversely influence businesses, which is why most companies track it. It can assist businesses in the following forms:

Cash Flow Management

The ratio provides insights into how efficiently a company converts its credit sales into cash. A higher ratio suggests quicker cash conversion, which improves overall cash flow. A lower ratio suggests that the company may experience financial difficulties.

Credit Policy Evaluation

The ratio helps in determining the efficiency of a company's credit policy and terms. Monitoring variations in the ratio over time may drive adjustments in credit terms to align them with business objectives.

Early Detection of Collection Issues

Changes in the ratio may indicate an issue with customer payments. A declining ratio may drive companies to identify and address collection challenges promptly.

Investor and Creditor Confidence

The ratio is used by investors and creditors to assess a company's creditworthiness. A higher turnover percentage indicates fast collection, which increases stakeholder confidence.

Strategic Decision-Making

Incorporating the ratio into financial planning and strategic decision-making processes allows businesses to make informed decisions related to credit policies, inventory management, and overall financial strategies.

Financial Health Indicator

The ratio serves as an indicator of a company's financial health. A well-managed accounts receivable turnover ratio contributes to a positive financial outlook.

Risk Management

A thorough understanding of the Accounts Receivable Turnover Ratio enables companies to detect and minimize any risks associated with payment delays, economic downturns, or changes in customer behavior.

Budgeting and Forecasting

The ratio helps companies make accurate estimates based on previous patterns and predicted changes in credit management procedures throughout the budgeting and forecasting process.

What's a Good Receivables Turnover Ratio?

The ideal Accounts Receivable Turnover Ratio varies depending on industry norms, business models, and specific circumstances. A higher ratio is generally regarded as a positive sign since it indicates a faster conversion of credit sales into cash. Yet, what is considered a good ratio can depend on factors such as the nature of the business, industry practices, and the company's specific goals.

However, some general considerations such as comparing the ratio to industry standards, assessing the company's credit terms, and understanding its cash flow requirements are crucial in determining the appropriateness of the ratio.

Regular monitoring and contextual analysis help businesses gauge the effectiveness of their credit management practices and adapt to industry dynamics.

Accounts Receivable Turnover Ratio Example

Let's say Company X has the following information for the year:

Net credit sales: $500,000

Beginning accounts receivable: $50,000

Ending accounts receivable: $30,000

Step 1: Calculate the average accounts receivable.

Average Accounts Receivable = Beginning Accounts Receivable+Ending Accounts Receivable ÷ 2

{$50,000 + $30,000}{2} = $40,000

Step 2: Use the formula for the accounts receivable turnover ratio.

Accounts Receivable Turnover Ratio = Net Credit Sales ÷ Average Accounts Receivable

{$500,000}{$40,000} = 12.5

The accounts receivable turnover ratio for Company X is 12.5. This means, on average, Company X collected its receivables 12.5 times during the year. A higher ratio is generally favorable as it indicates quicker turnover and efficient management of receivables as discussed in this article.

Limitations of the Accounts Receivable Turnover Ratio

While the Accounts Receivable Turnover Ratio is a useful measure for analyzing a company's efficiency in managing receivables, there are certain limitations to be aware of:

Not Industry-Specific

Industry norms vary, and what qualifies as a good ratio in one industry may not be good in another. Comparisons should be made within the context of the specific industry.

Lack of Detailed Insight

The ratio may not give precise insights into the reasons for variations in turnover. Changes in customer payment behavior or economic conditions, for example, may have an unnoticed impact on the ratio.

Potential Seasonal Changes

Seasonal variations in sales might affect the ratio. Peak season turnover may skew the annual average, potentially masking issues during slower periods.

Sales Ratio Consideration

Some businesses use total sales rather than net sales. This kind of mistake skews the results by making a company's calculation look higher. When evaluating an externally calculated ratio, make sure you understand how it was calculated.

Accounts management is easy with Enerpize.

Try our accounting module to manage your turnover accounts