Author : Enerpize Team

Reviewed By : Enerpize Team

How to Calculate Liabilities: A Detailed Guide with Examples

Liabilities are a key part of any financial picture, whether you're running a business or managing personal finances. Knowing how much you owe, when it's due, and how it affects your overall financial position is crucial. This guide explains everything you need to know about calculating liabilities, from short-term and long-term debts to tax and current obligations, with clear steps and real-world examples to help you apply the concepts easily.

Key Takeaways

- Liabilities are debts or obligations owed by a business or individual.

- They are categorized as short-term (current) and long-term liabilities.

- Calculating total liabilities involves summing both short-term and long-term debts.

- Tax liabilities require identifying taxable income and applying relevant tax rates and deductions.

- Current liabilities include obligations like wages, accounts payable, and short-term loans.

What are Liabilities?

Liabilities are financial obligations or debts that a business or individual owes to others. They represent claims against the company's assets, and they must be settled over time through the transfer of money, goods, or services. Liabilities can be short-term (due within a year) or long-term (due after more than a year), such as loans, accounts payable, or mortgages.

How To Calculate Liabilities?

Calculating liabilities involves identifying and summing up all financial obligations that a business or individual must pay. These debts can vary in duration, from short-term to long-term, and understanding how to calculate them accurately is crucial for assessing financial health. Below are the steps to calculate liabilities:

1- Identify All Outstanding Debts

Begin by listing all the debts and financial obligations the business has, such as loans, credit lines, accounts payable, and taxes owed.

May help you: Free Accounts Payable Template

2- Classify Liabilities

Group the liabilities into short-term (due within one year) and long-term (due after one year). This will help with proper accounting and financial analysis.

3- Sum Up Short-Term Liabilities

Add up all the short-term debts, including accounts payable, short-term loans, and other current liabilities.

4- Sum Up Long-Term Liabilities

Add all long-term obligations, such as long-term loans, bonds payable, and mortgages.

5- Total Liabilities

Combine the total of short-term and long-term liabilities to get the overall liabilities of the business.

6- Cross-Check Against Assets

Ensure that liabilities are in balance with assets to assess the company's financial stability.

Examples of Calculating Liabilities

Example 1: Short-Term Liabilities Calculation

Imagine a small retail store that needs to calculate its short-term liabilities at the end of the month. The store has the following short-term obligations:

- Accounts Payable: The business owes $5,000 to its suppliers for goods purchased on credit.

- Short-Term Loan: The store borrowed $3,000 from a bank to cover operational expenses, due for repayment within six months.

- Wages Payable: ABC Mart needs to pay $2,000 in wages to its employees within the next week.

Total Short-Term Liabilities = $5,000 + $3,000 + $2,000 = $10,000

Example 2: Long-Term Liabilities Calculation

A medium-sized manufacturing company has some long-term financial obligations. These include:

- Mortgage Payable: The company has a mortgage loan of $50,000 for its office building, with a repayment term of 15 years.

- Bonds Payable: The corporation issued bonds to raise capital for expansion, with a total value of $20,000, which will mature in 10 years.

Total Long-Term Liabilities = $50,000 + $20,000 = $70,000

Example 3: Total Liabilities Calculation

Combining both short-term and long-term obligations, the corporation needs to know its total liabilities to assess its overall financial standing. From the previous examples, we know:

- Short-Term Liabilities: $10,000

- Long-Term Liabilities: $70,000

Total Liabilities = $10,000 + $70,000 = $80,000

Read Also: Contingent Liabilities: Meaning, Examples, And How To Record

How to Calculate Total Liabilities

Calculating total liabilities involves adding together both short-term and long-term obligations of a business or individual. Here's how to accurately calculate total liabilities:

1- Identify Short-Term Liabilities

Short-term liabilities are debts or obligations that are due within one year. These include:

- Accounts payable

- Short-term loans or credit

- Wages payable

- Taxes owed

- Current portion of long-term debt

Example:

If a business has the following short-term liabilities:

- Accounts Payable: $5,000

- Short-Term Loan: $3,000

- Wages Payable: $2,000

Total Short-Term Liabilities = $5,000 + $3,000 + $2,000 = $10,000

2- Identify Long-Term Liabilities

Long-term liabilities are obligations that are due after one year. These include:

- Long-term loans

- Mortgages payable

- Bonds payable

- Lease obligations

Example:

If the business has the following long-term liabilities:

- Mortgage Payable: $50,000

- Bonds Payable: $20,000

Total Long-Term Liabilities = $50,000 + $20,000 = $70,000

2- Calculate Total Liabilities

Once you have both short-term and long-term liabilities, add them together to calculate total liabilities.

Formula:

Total Liabilities = Short-Term Liabilities + Long-Term Liabilities

Example:

Using the amounts from the previous examples:

- Short-Term Liabilities = $10,000

- Long-Term Liabilities = $70,000

Total Liabilities = $10,000 + $70,000 = $80,000

The total liabilities of the business would be $80,000, which represents all the debts the business owes, both in the short term and over the long term.

You may also like: How to Calculate Accrued Liabilities

How to Calculate Tax Liabilities

Tax liabilities refer to the amount of money a business or individual owes in taxes to the government. Calculating tax liabilities involves determining the appropriate tax rate, applying it to taxable income, and considering any applicable deductions, credits, or exemptions.

1- Determine Taxable Income

Taxable income is the income that is subject to taxation after accounting for allowable deductions. This could include:

- Gross income (revenue or earnings)

- Deductions (e.g., business expenses, standard deductions, tax credits)

Example:

If a business has $100,000 in gross income and qualifies for $20,000 in deductions:

Taxable Income = Gross Income - Deductions = $100,000 - $20,000 = $80,000

2- Apply the Tax Rate

The tax rate depends on the type of tax (e.g., income tax, corporate tax) and the jurisdiction. Tax rates can be flat (single rate) or progressive (multiple tax brackets).

Example:

Assume a tax rate of 20% for the taxable income:

Tax Liability = Taxable Income × Tax Rate = $80,000 × 20% = $16,000

3- Consider Tax Credits and Exemptions

Tax credits directly reduce the amount of tax owed, while exemptions reduce the taxable income itself. If applicable, subtract any credits or exemptions from the calculated tax liability.

Example:

If the business qualifies for a $2,000 tax credit:

Adjusted Tax Liability = Tax Liability - Tax Credit = $16,000 - $2,000 = $14,000

4- Final Tax Liability

The result is the final amount the business or individual owes in taxes after deductions, credits, and exemptions have been applied.

Example:

In this case, after applying the deductions and credits, the business's final tax liability would be $14,000.

How to Calculate Current Liabilities

Current liabilities are short-term financial obligations that a business must settle within one year. They are crucial for understanding a company’s short-term financial health and liquidity. Here’s the calculation steps:

1- List All Current Liabilities

Start by identifying all debts and obligations due within a year. Common current liabilities include:

- Accounts Payable

- Short-Term Loans

- Wages Payable

- Taxes Payable

- Interest Payable

- Unearned Revenue

Current Portion of Long-Term Debt

2- Assign Monetary Values

Next, determine the exact amount owed for each current liability.

Example:

Let’s say a business has the following liabilities:

- Accounts Payable: $4,000

- Short-Term Loan: $6,000

- Wages Payable: $3,000

- Taxes Payable: $2,000

Current Portion of Long-Term Debt: $5,000

3- Add the Amounts

Sum up the values of all the listed current liabilities.

Total Current Liabilities =

$4,000 (Accounts Payable) + $6,000 (Short-Term Loan) + $3,000 (Wages Payable) + $2,000 (Taxes Payable) + $5,000 (Current Portion of Long-Term Debt) = $20,000

4- Final Result:

The total current liabilities for the business are $20,000, meaning it owes this amount within the next 12 months.

Streamline Calculating Liabilities with Enerpize

Enerpize is a cloud-based business management software designed to simplify your accounting, inventory, HR, and operations—all in one system. It offers intuitive tools to help small and medium-sized businesses manage finances with ease and accuracy.

Enerpize online accounting software makes managing and calculating liabilities effortless by automating your accounting processes and keeping your financial data organized in one place. Whether you're tracking short-term debts like accounts payable or long-term obligations such as loans and mortgages, Enerpize simplifies every step.

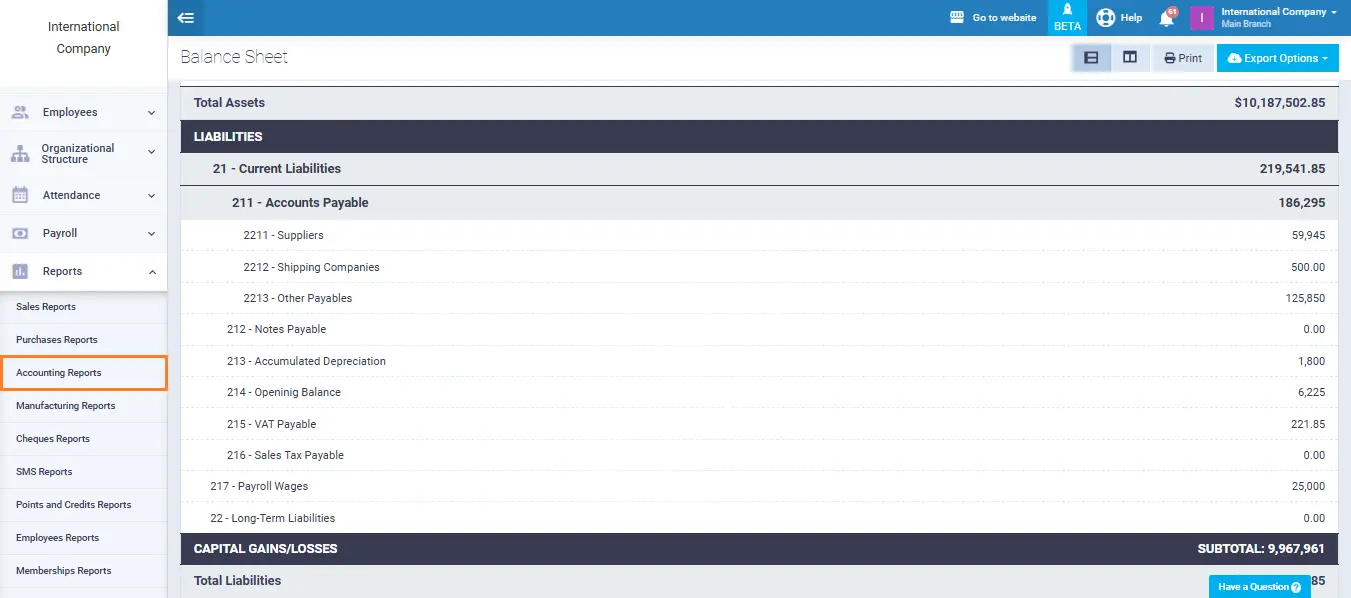

Enerpize helps in the following:

- Real-Time Liability Tracking: Provides up-to-date financial reports showing current and long-term liabilities.

- Automated Journal Entries: Records liabilities automatically based on transactions and purchases.

- Balance Sheet Integration: Reflects total liabilities directly in the balance sheet for accurate financial representation.

- Smart Alerts: Sends reminders for upcoming due payments, like loans and supplier invoices.

- Customizable Reports: Allows generation and export of detailed liability reports as needed.

Calculating liabilities is easy with Enerpize.

Try our accounting module to calculate your total liabilities automatically.