Author : Haya Assem

Reviewed By : Enerpize Team

Discounted Cash Flow (DCF): Formula, Examples & Cumulative DCF

Table of contents:

- What is Discounted Cash Flow (DCF)?

- Discounted Cash Flow Formula

- How to Calculate Discounted Cash Flow

- Example of Calculating Discounted Cash Flow (DCF)

- How to Calculate Cumulative Discounted Cash Flow

- Why Should You Calculate Discounted Cash Flow?

- Limitations of Discounted Cash Flow

- Common Mistakes in Calculating DCF and How to Avoid Them

- Calculate Discounted Cash Flow with Excel

- Streamline Calculating Discounted Cash Flow

Calculating discounted cash flow (DCF) is an essential financial technique used to assess the value of an investment, project, or business. Determining the present value of future cash flows helps investors and businesses evaluate whether an investment is worthwhile, factoring in the time value of money and associated risks.

The DCF method is particularly useful in comparing investment opportunities and determining the potential return on capital. Long-term investments or projects' discounted cash flow can be determined by using the cumulative discounted cash flow, which sums the present values of all expected future cash flows over multiple periods, providing a more comprehensive view of an investment's total value.

Key Takeaways

- Discounted cash flow is a financial method used to assess the value of an investment by calculating the present value of future cash flows, accounting for the time value of money and associated risks.

- DCF helps investors evaluate whether an investment is worthwhile, particularly in comparing investment opportunities and determining the potential return on capital.

- The DCF formula involves discounting future cash flows using a chosen discount rate over specified periods.

- For long-term investments, cumulative discounted cash flow sums the present values of cash flow over multiple periods, providing a more comprehensive view of an investment’s total value.

- The final discounted cash flow value should be compared with the investment cost to determine if it represents a viable and profitable opportunity.

What is Discounted Cash Flow (DCF)?

Discounted Cash Flow (DCF) is a valuation method used to estimate the value of an investment, company, or project based on its expected future cash flows. The future cash flows are projected and then discounted to their present value using a discount rate that reflects the risk and time value of money.

Importance of DCF for Businesses

DCF is crucial for businesses because it provides a clear, quantitative estimate of an asset’s value. It helps managers, investors, and stakeholders make informed decisions about investments, acquisitions, or capital projects by assessing whether the expected returns justify the risk and cost of capital.

Key Types of Free Cash Flow Used in DCF

- Free Cash Flow to the Firm (FCFF): Represents the cash available to all investors, both equity and debt holders. Used when valuing the entire firm.

- Free Cash Flow to Equity (FCFE): Represents the cash available only to equity shareholders after debt payments. Used when valuing equity specifically.

The DCF method ultimately helps determine the intrinsic value of a company or investment, which can then be compared to its market price to assess if it is overvalued or undervalued.

Discounted Cash Flow Formula

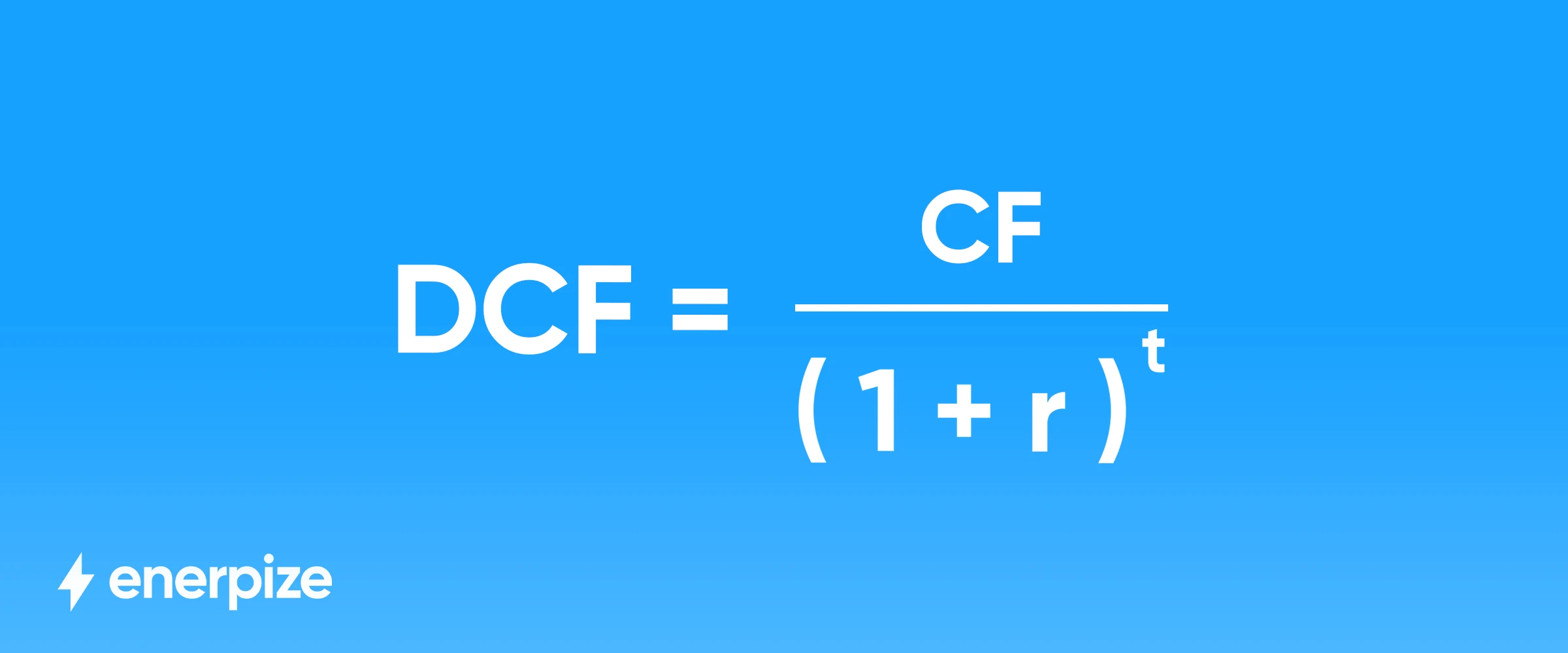

Calculating the discounted cash flow requires following a simple formula, which discounts future cash flows back to their present value.

The formula for Discounted Cash Flow (DCF) is:

CF: Cash flows for a period.

(r): This is the discount rate.

(n): This is the number of periods (years).

How to Calculate Discounted Cash Flow

The discounted cash flow method is a widely used financial valuation technique to assess the value of an investment, business, or project. It calculates the present value of expected future cash flows by considering the time value of money and the associated risks. By discounting future cash flows to their current value, DCF provides a way to determine whether an investment is worthwhile. Here are the steps to calculate DCF:

1- Identify Future Cash Flows

Estimate the expected future cash inflows (revenues or returns) and outflows (costs or expenses) for each time period, typically broken down annually or quarterly. These should be realistic projections based on the nature of the investment or project.

2- Determine the Discount Rate

Choose an appropriate discount rate that reflects both the time value of money and the specific risks associated with the cash flows. The weighted average cost of capital (WACC) is commonly used as the discount rate because it represents the company’s overall cost of financing, combining the cost of equity and debt while reflecting the risk of the business.

The weighted average cost of capital (WACC) accounts for the proportion of debt and equity in the company’s capital structure, incorporating the cost of equity, the cost of debt, and tax benefits from interest.

3- Calculate the Present Value of Each Cash Flow

For each future cash flow, use the formula to discount it to its present value:

Apply this for each period (e.g., year 1, year 2, etc.).

4- Sum the Present Values of All Cash Flows

Add up the present values of all individual future cash flows to obtain the total present value of the expected cash inflows and outflows. This total represents the overall value of the investment or project based on discounted future cash flows.

5- Interpret the Result

The result is the total discounted cash flow, representing the present value of all future cash flows. Compare this total value to the current cost or market price of the investment to determine if the investment is attractive. If the DCF is higher than the investment cost, it may be considered a good investment.

If you want a ready template, download our free Discounted Cash Flow Template NOW!

Read Also:

Cash Flow Statement: Definition & How To Read

Pro Forma Cash Flow Statement: A Comprehensive Guide

Direct VS Indirect Cash Flow: A Comprehensive Guide

Example of Calculating Discounted Cash Flow (DCF)

Let’s assume we are valuing a company using free cash flow to the firm (FCFF). The projected cash flow for the next 5 years is estimated, and the discount rate (WACC) is 10%. We will also calculate the terminal value at the end of year 5 using a perpetual growth rate (g) of 3%.

Step 1: Projected FCFF (in $ million)

| Year | Projected FCFF | Discount Factor (10%) | Present Value (PV) |

| 1 | 50 | 0.909 | 45.45 |

| 2 | 55 | 0.826 | 45.43 |

| 3 | 60 | 0.751 | 45.06 |

| 4 | 65 | 0.683 | 44.40 |

| 5 | 70 | 0.621 | 43.47 |

Step 2: Calculate Terminal Value (TV)

Terminal Value Terminal Value = FCFF Year 5 × (1 + g) / (WACC – g)

TV = 70 × (1 + 0.03) / (0.10 – 0.03) = 70 × 1.03 / 0.07 ≈ 1,030.0

Step 3: Discount Terminal Value to Present Value

PV of TV = 1,030 × 0.621 ≈ 639.6

Step 4: Calculate Total DCF Value

Total DCF = Sum of PVs of FCFF + PV of Terminal Value

Total DCF = (45.45 + 45.43 + 45.06 + 44.40 + 43.47) + 639.6 ≈ 863.4

The estimated intrinsic value of the company based on this DCF example is approximately $863.4 million. Comparing this to the market value helps determine if the company is overvalued or undervalued.

Read Also: What Is the Net Cash Flow: Importance and Equation

How to Calculate Cumulative Discounted Cash Flow

Cumulative discounted cash flow is the sum of discounted cash flows for each period over multiple years. Each cash flow is discounted to present value and then added together.

Cumulative Discounted Cash Flow Formula

To calculate cumulative discounted cash flow:

1- Discount each year’s cash flow to its present value:

PV = Cash Flow ÷ (1 + r)ⁿ

where r = discount rate, n = year number.

2- Add all discounted values together:

Cumulative DCF = PV₁ + PV₂ + PV₃ + … + PVₙ

This gives you the total economic value generated across multiple years, adjusted for the time value of money.

Example

Suppose you're considering an investment that is expected to generate the following cash flows over the next 3 years:

- Year 1: $10,000

- Year 2: $12,000

- Year 3: $15,000

The discount rate is 8% (0.08).

Steps to Calculate DCF:

1- Identify Future Cash Flows

Year 1: $10,000

Year 2: $12,000

Year 3: $15,000

2- Determine the Discount Rate

The discount rate is given as 8%, or 0.08.

3- Calculate the Present Value of Each Cash Flow

For each future cash flow, apply the DCF formula:

4- Sum the Present Values of All Cash Flows

Now, add the present values of all three cash flows:

DCF = 9,259.26 + 10,290.02 + 11,906.81 = 31,456.09

5- Interpret the Result

The total DCF is $31,456.09. This is the present value of all future cash flows from the investment, discounted at 8%. If the current cost of the investment is less than $31,456.09, it could be considered a good investment, assuming other factors are favorable.

Read Also: What Is Levered Free Cash Flow? And How to Calculate?

Why Should You Calculate Discounted Cash Flow?

Calculating discounted cash flow is essential for business owners, investors, and financial analysts because it provides a realistic estimate of an asset’s true economic value. Unlike profit figures or revenue growth, which accounting methods can influence, DCF focuses purely on future cash generation, making it one of the most reliable valuation tools.

Accounts for the Time Value of Money

DCF recognizes that future cash flows are worth less than cash today, giving a more accurate view of long-term value.

Provides a Clear Estimate of Intrinsic Value

It helps determine whether a business, project, or investment is undervalued or overvalued compared to its current market price.

Useful for Long-Term Decision Making

Businesses use DCF to assess expansion plans, equipment purchases, or new product investments based on expected future returns.

Works Across Different Industries

As it focuses on cash flow rather than industry-specific metrics, DCF can be applied to companies, real estate, projects, or financial assets.

Helps Compare Multiple Opportunities

DCF allows investors and managers to evaluate several investment options using a consistent, objective method.

Highlights Risk and Required Returns

By using discount rates such as WACC, DCF shows how risk impacts present value and expected profitability.

Limitations of Discounted Cash Flow

While Discounted Cash Flow is a powerful valuation method, it also has several limitations that can affect accuracy. Understanding the following drawbacks helps businesses and investors use DCF more cautiously and complement it with other valuation tools.

Highly Sensitive to Assumptions

Small changes in growth rates, discount rates, or cash flow projections can significantly alter the final valuation, making the outcome less reliable.

Requires Accurate Long-Term Forecasting

Estimating future cash flows over many years is difficult, especially for startups, cyclical industries, or businesses facing uncertain market conditions.

Discount Rate Selection Is Complex

Using the wrong discount rate (e.g., incorrect WACC) can overvalue or undervalue a business dramatically.

Terminal Value Can Dominate the Valuation

In many models, the terminal value represents more than half of the total DCF, meaning any error in terminal assumptions has a major impact.

Not Suitable for Businesses with Unstable Cash Flow

Companies with irregular, unpredictable, or negative cash flows produce unreliable DCF results.

Ignores Market Conditions and Competitor Behavior

DCF focuses on internal cash flows and does not reflect external market trends, competition, or investor sentiment.

Common Mistakes in Calculating DCF and How to Avoid Them

Even though discounted cash flow is a widely trusted valuation method, many analysts make avoidable errors that lead to inaccurate results. Recognizing these mistakes early helps ensure your DCF model stays reliable and realistic.

Using Unrealistic Growth Assumptions

Many valuations fail because they assume overly optimistic revenue or cash flow growth.

To avoid this, base your projections on historical performance, industry benchmarks, and realistic market expectations, not guesswork.

Applying the Wrong Discount Rate

An incorrect WACC or discount rate can dramatically distort a company’s valuation.

Avoid this mistake by carefully calculating WACC using updated capital structure, borrowing costs, and market risk premiums.

Overreliance on Terminal Value

If the terminal value dominates the valuation, your DCF model becomes unstable.

Prevent this by choosing a reasonable forecast period and using conservative, well-supported terminal growth assumptions.

Ignoring Changes in Working Capital

Skipping working capital adjustments leads to inaccurate free cash flow calculations.

Always include increases or decreases in receivables, payables, and inventory to ensure realistic cash flow estimates.

Not Matching Cash Flow Type With the Discount Rate

Using FCFE with WACC or FCFF with the cost of equity results in incorrect valuations.

Use FCFF with WACC and FCFE with the cost of equity to maintain consistency and accuracy.

Using Nominal and Real Values Incorrectly

Mixing nominal cash flows with real discount rates (or vice versa) skews the results.

Stay consistent, use nominal cash flows with nominal discount rates or real cash flows with real discount rates.

Failing to Stress-Test Assumptions

DCF models based on a single scenario often fail in uncertain conditions.

Improve reliability by running sensitivity analyses on key variables such as growth rates, discount rates, and terminal value assumptions.

Calculate Discounted Cash Flow with Excel

For faster setup, you can download and use Enerpize's ready-made Discounted Cash Flow Excel template, which includes built-in formulas and a structured layout to help you calculate DCF accurately and save time.

Streamline Calculating Discounted Cash Flow

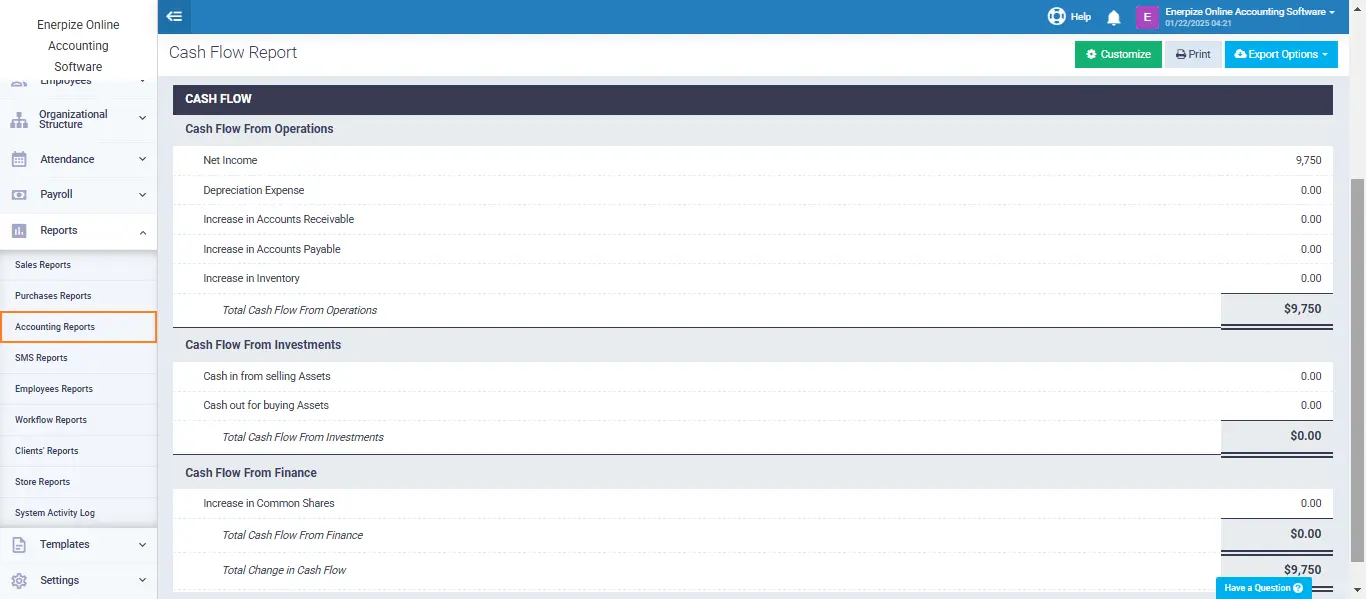

Enerpize online accounting software can streamline the calculation of discounted cash flow by automating key aspects of the process. It helps by generating accurate cash flow projections based on entered financial data from the cash flow statement, which is crucial for DCF analysis. Users can input different discount rates, such as the required rates of return, and Enerpize will automatically discount future cash flows to their present value, reducing manual calculations and minimizing the risk of errors.

Additionally, Enerpize simplifies the reporting of DCF results, presenting projected cash flows, present values, and overall enterprise value in an easy-to-understand format for stakeholders. Its audit trail and record-keeping features ensure transparency and accountability in the DCF process, allowing for verifiable and reliable analysis. By leveraging Enerpize's automated tools, businesses can efficiently and accurately perform DCF calculations, ultimately enhancing decision-making and financial planning.

Calculating discounted cash flow is easy with Enerpize.

Try our accounting module to manage cash flow accurately.