Author : Haya Assem

Reviewed By : Enerpize Team

Pos Tracking: Definition and How to Do

Table of contents:

A Point of Sale (POS) transaction refers to the moment a customer completes a purchase by paying for products or services, whether in-store or online, using various payment methods like credit cards, mobile wallets, or cash. These transactions are processed through a combination of POS software and hardware, enabling businesses to track sales, generate receipts, manage inventory, and maintain accurate financial records. Whether operating a physical retail outlet or an eCommerce store, POS transactions are the backbone of seamless, secure, and trackable sales processes.

Key Takeaways

- POS transactions refer to payments made through systems like credit/debit cards or mobile devices in-store or online, tracked via POS software.

- POS systems help manage sales, process payments, generate receipts, track inventory, and store transaction data digitally for better reliability.

- A typical POS example involves scanning items in a store, generating a bill, and completing the transaction with a card or cash payment.

- POS credit card transactions draw funds from a customer’s credit line, verified and approved by the card network before completion.

- POS transaction types include online (e.g., eCommerce purchases), offline (in-store purchases), and special cases like returns or refunds.

- POS tracking involves checking transaction logs, ensuring secure processing, complying with regulations, and integrating with accounting software.

- Both POS transactions and reconciliations involve sales data, affect financial records, and often require system integration for consistency.

- POS reconciliation benefits include catching fraud, ensuring record accuracy, improving cash flow, managing inventory, and enhancing CRM strategies.

What is a POS transaction?

A Point of sales (POS) transaction is the process where a transaction takes place from a customer's payment method typically using electronic systems such as credit or debit cards, or mobile devices to the merchant in exchange for products or services through POS software. The process usually takes place in a physical store but can also occur online or through mobile payment systems. They provide a convenient and efficient way to process payments, track the sales of products or services, manage inventory, and provide a record of the transaction for both the customer and the business. The entire process is typically managed through point of sale software, which serves as the main part of the transaction, as well as POS hardware, which includes elements such as a credit card reader, a cash register, or even a tablet, but both act as part of the process in order to provide a seamless sales experience and safely stored financial records.

POS transaction example

The simplest and most typical POS transaction example is the process that usually takes place in a supermarket where customers pick their preferred items. Then the shop staff scans the selected items and produces a receipt or a bill at the checkout counter. A POS transaction happens when the customer pays for it with cash or a credit card.

What is a POS transaction on a credit card?

The credit card POS transaction is a part of the electronic process of purchasing at a retail store or a commercial business. When a client uses a credit card to make a payment, the amount withdrawn is from the credit card network, which the user can repay later. Typically, the card is inserted or tapped on a POS terminal. The transaction details, including the purchase price, are subsequently sent to the credit card company for approval. The card's validity is checked, the available credit is checked, and the transaction is performed if approved. POS credit card transactions provide a simple and efficient means for consumers to make purchases without the need for cash, as well as a secure method of collecting payments while keeping a record of transactions for both parties.

Read Also: A Comprehensive Guide to Retail POS Systems

Point of sale transaction types

There are various forms of POS transactions; each sale or purchase involves a transaction of money but through various payment methods and customer preferences. Here are some common POS transaction types:

POS online transactions

A POS online transaction is the process of making an online purchase using electronic payment methods. Customers in an online retail environment can choose products or services, place them in a virtual shopping cart, and proceed to the checkout page. The transaction is subsequently handled by the online POS system, which includes collecting payment information and verifying the purchase. There are various forms of online payment methods and the most common are credit/debit cards, and digital wallets (such as Apple Pay).

POS offline transactions

Offline POS transactions take place in physical stores. POS systems may perform transactions offline and then sync with the central server in some cases. This is beneficial in cases where a reliable internet connection is not available. All sales data is stored in the web browser and saved until you are ready to sync the data to the back office. If the orders included credit card payments, the payments can also be performed during the syncing process. Both online and offline transactions are further classified into three types:

Sales

This sort of transaction occurs when a product or item is sold, whether in a physical store or an online store. The POS system keeps a close watch on the quantity of items sold, the amount of cash collected, the date and time of purchase, the employee managing the transaction, and the customer information.

Purchases

A POS transaction occurs when a buyer purchases a product or service from anywhere and exchanges money for it. All data associated with the purchase is recorded by the POS system.

Receipts

After the buyer has made the payment, a receipt is generated by the seller for the buyer. Receipts often include the POS transaction details such as the transaction date, a description of the items purchased, the quantity purchased, the total amount paid, and any relevant taxes. Receipts are useful for record-keeping, tracking expenses, and proof of a completed transaction.

Return of products

A refund when a client returns a product to the store, the POS transaction is effectively a reverse transaction. The POS transaction system requests the card-issuing bank to reverse the payment for a refund. Depending on the conditions surrounding the return, the refund might be partial or total.

Read Also: Explaining The POS Transaction on Bank Statement

For more about types, check out our detailed explainer: POS Transaction Types: Explanation With Examples

How to track POS transactions

In fact, POS transactions can be tracked, however, it's important to note that this tracking is typically done by authorized entities for valid reasons:

1- Transaction Logs

Review the transaction logs generated by your POS system regularly. Each transaction is recorded in these logs, including the date, time, items purchased, and payment method. These records are readily accessible to all those with authorization and serve a variety of functions such as accounting, customer support, and dispute settlement.

2- Secure Payment Processing

It is critical to provide secure payment processing for both customer trust and regulatory compliance. Select a POS system that follows industry-standard safety regulations. This includes compliance with the Payment Card Industry Data Security Standard. Payment information should be encrypted during transmission and storage by POS systems, safeguarding it from unauthorized access.

3- Adherence to Legal and Regulatory Standards

Legal and regulatory standards play a crucial role in overseeing financial transactions. In situations involving accusations of fraud or criminal activities, law enforcement agencies may obtain warrants to access transaction records.

4- Keep Up with POS Technology

To simplify financial tracking, integrate your POS system with accounting software. This facilitates the reconciling of sales and financial records. Keep your POS system and software up-to-date to benefit from the latest features, security patches, and improvements in transaction tracking capabilities.

Read Also: 6 Reasons that Shows You Why to Use Online Accounting Software

Similarities between POS reconciliations and POS transactions

Data Involvement

Both POS reconciliations and POS transactions involve data related to sales. POS transactions record the details of individual sales, including the items purchased, quantities, prices, and payment methods. POS reconciliations, on the other hand, involve comparing various transaction records, such as sales data, to ensure consistency and accuracy.

Financial Implications

POS reconciliations and POS transactions both have financial implications. POS transactions have a direct influence on revenue by documenting sales and processing payments. POS reconciliations help to ensure financial accuracy by confirming that recorded transactions match other financial records, reducing the risk of errors and discrepancies.

Integration of Systems

Both methods frequently entail system integration. POS transactions may be integrated with inventory management, customer relationship management (CRM), and financial accounting systems. POS reconciliations may require integration with accounting software to compare transaction records with other financial data.

Advantages of POS reconciliation

POS reconciliation is an important activity for preserving a company's financial health and enabling informed decision-making. Since it assists organizations in maintaining healthy financial accounts by providing all of the following advantages:

Accuracy assurance

POS reconciliation helps ensure the accuracy of financial records. Comparing POS transaction data with other financial records can help reduce the risk of errors in reporting and financial statements.

Fraud detection

Regular POS reconciliation may be a very effective strategy for detecting fraudulent activity. Inconsistencies in transaction data may indicate possible fraud, causing organizations to investigate and take corrective action.

Inventory management

POS reconciliation plays a vital role in managing inventory effectively. By reconciling POS data with inventory records, businesses can help minimize stockouts, prevent overstocking, and improve overall supply chain efficiency.

Read more about an inventory management method: ABC Analysis Method

Management of cash flows

Accurate POS transaction reconciliation adds to better cash flow management. Businesses may guarantee that their financial accounts correspond to the real funds received by validating cash and card transactions with recorded sales.

Customer relationship management (CRM)

Businesses may improve their CRM efforts by using POS reconciliation. As they may customize marketing campaigns and enhance customer satisfaction by tracking the customer purchase trends and preferences using POS data.

Read Also: Best Restaurant POS Systems For 2026 And How To Choose One

How can Enerpize help in managing POS transactions?

Enerpize presents a comprehensive online POS software solution designed to optimize the management of a store's point-of-sale system, ensuring a seamless and efficient retail experience.

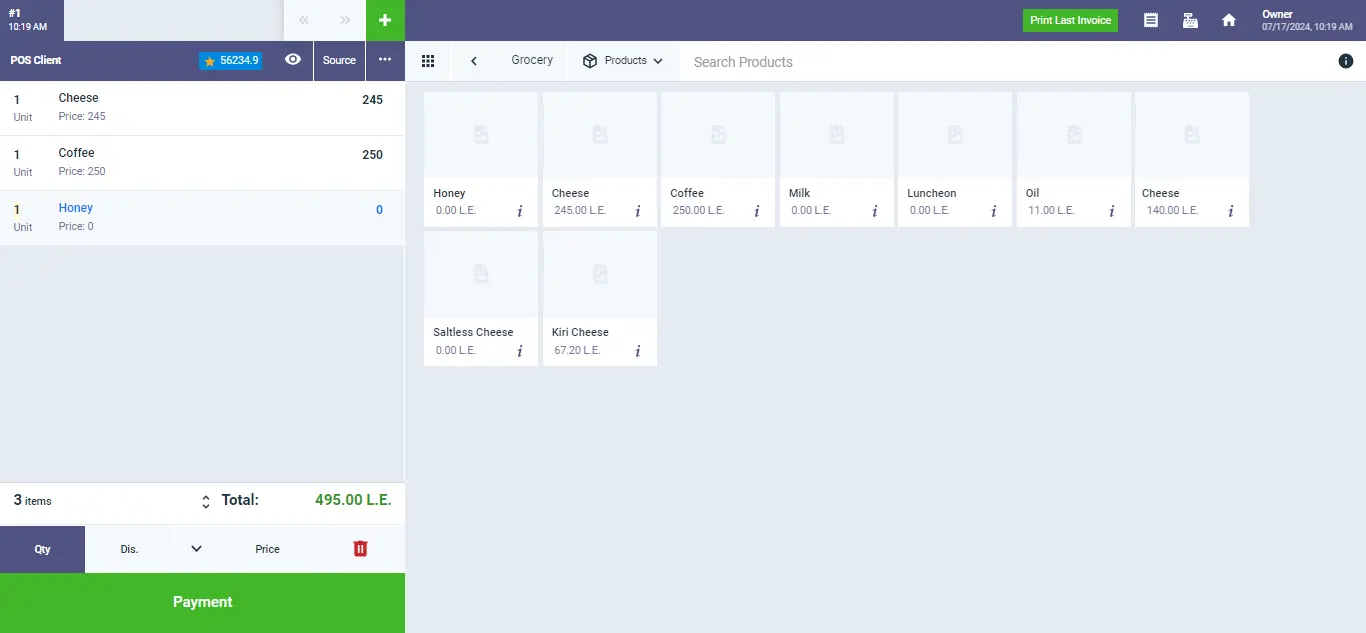

This user-friendly platform facilitates the streamlined handling of sales sessions, work shifts, and personnel management. The software seamlessly integrates with POS devices, offering a convenient interface to display product lists enriched with names and images. Users can expedite the product input process with barcode support, efficiently issue invoices, and effortlessly input pricing, discounts, and tax details.

This ensures a quick and accurate transaction process, enhancing the overall efficiency of the sales system. To enhance business intelligence, the software enables the generation of detailed reports that track sales movement, issued invoices, and profits based on various parameters such as each product, category, or work shift. This feature provides a clearer understanding of earnings, allowing businesses to make informed decisions and optimize their sales strategies.

In essence, Enerpize's online POS software is a versatile tool that not only simplifies day-to-day retail operations but also empowers businesses with valuable insights for strategic growth.

Here is a brief overview of the POS module in Enerpize:

Read Also:

How Mobile Repair Shop Software Can Boost Your Sales

How Can Enerpize Boost Your Business As Payment Management Software?

Final thoughts

In conclusion, the realm of POS transactions stands at the intersection of technology and commerce, reshaping how businesses engage with customers and manage financial processes. POS transactions play a pivotal role in the seamless functioning of modern retail, whether online or offline, through sales, purchases, or receipts. While POS reconciliation is performed to ensure the accuracy of all transactions helps businesses detect any fraud and assists businesses in maintaining healthy financial accounts. As a result, they are both critical to the health of a company's financial statements.

POS is easy with Enerpize.

Try our sales module to track your POS transactions